Add thank you gifts to giving forms in appreciation of your donors' generous contributions to your cause.

Giving Form Configuration

1. Start by opening the Giving Form configuration, and toggle the "Thank You Gift" element "ON"

2. Add the gift name as you'd like it to appear to donors. Then, configure the minimum donation amounts required for donors to receive this gift. You may choose to configure either a one-time donation threshold amount, a recurring donation threshold amount, or both.

3. Add a Gift Description and optional image to show donors what gift they will be receiving for their donation.

4. Add a "Fair market value" amount to reflect the gift's value. This is just for the backend and will not appear to the donor. Similarly, add a SKU for backend tracking as well.

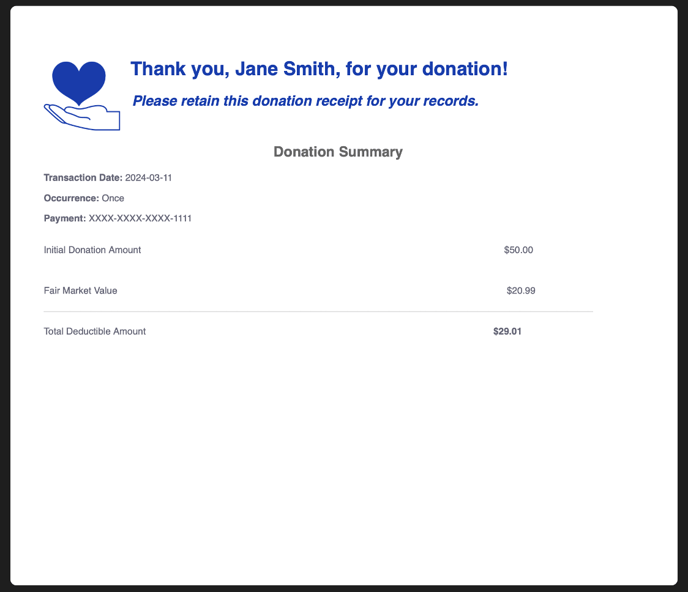

Confirmation Pages & Receipts

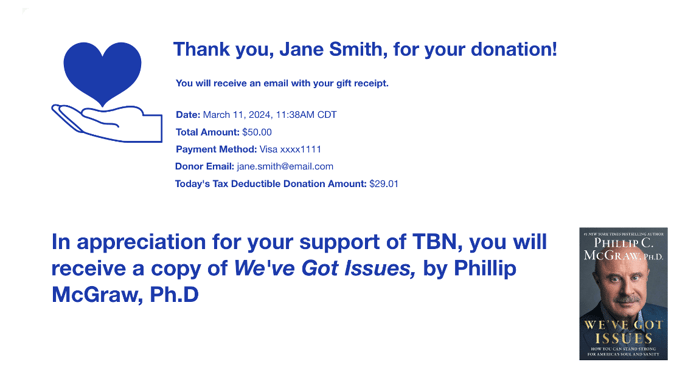

Use the "Fair Market Value" and "Deductible Amount" tags in your confirmation pages and receipts to seamlessly communicate to donors their tax-deductible gift amount.

Note: the calculation for deductible amount is Transaction Amount - Fair Market Value = Deductible Amount

The Donor Experience

1. The Thank You Gift will remain grayed-out until the donor selects the corresponding threshold amount on the Giving Form.

2. After filling out their payment information, the donor may choose to opt-out of the Thank You Gift if they do not wish to receive a gift for their contribution. They can click "Claim your gift" at any time if they change their mind.

3. After clicking "Give," the donor is redirected to the confirmation page, where they will see information about their donation.

4. The donor also receives a donation receipt to the email they provided following their donation.